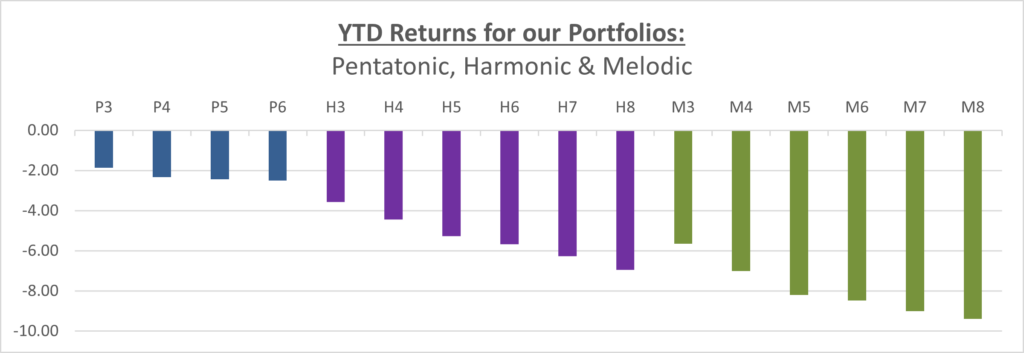

Having had a very productive 2021, with Portfolios growing in line with expectations, we have seen virtually all of this growth disappear since January 1st as Portfolios have dropped by between 5% and 8% in January.

We have not seen this level of volatility being sustained over a period of weeks since before Covid, when it was, in fact, fairly normal behaviour. During the Pandemic we might have seen the Market drop by a few percent but within days it would have recovered as Markets responded very quickly to bad news and to good news – or at least, the bad news not being so bad!

(click chart to enlarge and open in a new window)

We have reduced the portfolio return by the maximum ongoing fee a client could pay (except Offshore Bond investors). The figures for the Pentatonic Income Portfolio assume income is reinvested as we are unable to strip out the dividend that has been paid.

The Melodic Portfolios have more exposure to the US and having been one of the better performing Markets in 2021, we suspect that the fact it has dropped more this year, probably reflects the fact investors are using this as an opportunity to realise profits.

As a matter of interest, the Markets that did not perform well last year – such as Emerging Markets and Far East – have held up better in 2022. This of course, is why you have a diversified portfolio.

The Melodic Portfolios are Socially Responsible Investments (SRI) and have suffered more because of their higher exposure to the US.

Reasons for volatility

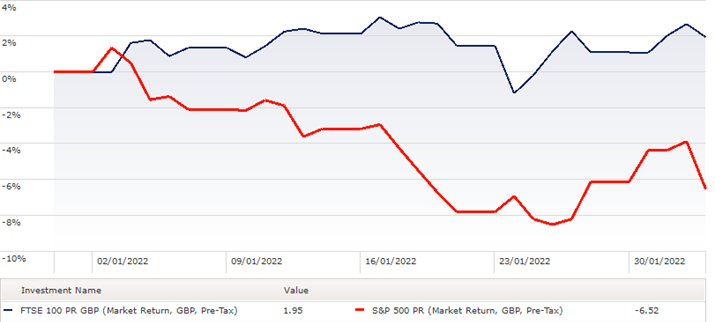

America has dropped because of concerns that interest rates will increase quicker than expected and be higher than anticipated. It was also concerned that the FED would stop its asset purchase programme.

The FED met last week and did not raise interest rates at that meeting but the signs are that it will in March. Also, whilst it did not stop the asset purchase programme, it did reduce the level by the previously announced amount. As a result, the Dow Jones has increased by almost 3% from its low on the 25th.

This has also affected the value of the $ and that has a knock-on effect for other economies.

(click chart to enlarge and open in a new window)

Omicron is causing a big surge in infections worldwide and this is affecting supply chains. This means it will take longer for supplies to be ‘normal’ and that means prices remain high. This is fuelling inflation and whilst certain counties welcome a higher inflation rate, the subsequent increase in interest rate – to help reduce people spending money and therefore fuelling inflation through market demand – is of concern as we see headlines quoting how much the ‘average’ UK household will see costs increase. Papers like to sensationalise everything and inflation will start to drop again in the summer as we see previous price increases – held back during the initial period of the Pandemic- fall out of the calculation.

This assumes that Russia doesn’t invade Ukraine because ensuing sanctions against Russia would drive up the price of oil, adding to inflationary pressures.

Outlook

Despite the current concerns detailed above, the general outlook is that there will be global growth this year and whilst this might be a little lower than we saw in 2021, and indeed a little more volatile, we are still confident with our asset spread.

Portfolio Reviews

This is when we review all the Model Portfolios and make changes to the Strategic Asset Allocation – i.e., reduce exposure to the UK in favour of Europe – we also review the funds we are using in each Sector.

We are not making any changes to the Strategic Asset Allocation at this time but have made a couple of fund changes within the Harmonic Portfolios, which will apply to new investments only at this stage.

However, they are very small changes and as a fund change would usually allow us to perform a re-balance, where we bring exposure back in line with the Model, we are not doing this at the moment because of the Market volatility. We will review this as and when the Markets settle down.

The information provided in this report is based on our own opinion and offers no guarantee that expectations will be met. Past performance is no guide to future results. As always, should you have any concerns you wish to raise, please do contact us.

Keep safe

Ian & Oliver