A look at 2021

Our Model Portfolios have all shown a positive return for 2021 as the following table shows. The returns per portfolio are an indication only and are to identify the growth per level of risk within each portfolio range.

(click chart to enlarge and open in a new window)

(click chart to enlarge and open in a new window)

I have reduced the portfolio return by the maximum ongoing fee a client could pay (except Offshore Bond investors). The figures for the Pentatonic Income Portfolio assume income is reinvested as I am unable to strip out the dividend that has been paid.

The Harmonic (H) Portfolios have more exposure to Asia and Emerging Markets as the targeted level of risk increases. These Markets did not recover so well in 2021 – the higher the level of risk, the more exposure they have – and as a result the Harmonic Portfolios have been affected more than the SRI. However, taking a longer term view, these areas have lots of potential for growth and therefore the gap between the SRI and unconstrained portfolios should reduce.

Fund Focus for January 2022

With so many clients now having exposure to Socially Responsible Investments via our Melodic Portfolios, often in addition to holding the unconstrained Harmonic Portfolios, we are now providing a report on funds within both portfolios.

Socially Responsible Investments (SRI) have become more popular over the last few years appealing to investors who have a preference towards avoiding investing in companies that produce or sell addictive substances (such as alcohol, gambling and tobacco), Armaments and nuclear power, in favour of companies that are engaged in social justice, environmental sustainability and alternative/clean energy and technology.

If you do not hold any Socially Responsible Investments and wish to do so, please contact us as it is easy enough to move part of your investment to this type of portfolio – no costs incurred either.

Fund Focus: Schroder Asian Alpha Plus Fund

This fund is used with in our Harmonic 4-8 portfolios and represents between 2-6% of the asset spread with in these portfolios.

The reason why we use this fund within our portfolios is to offer a level of diversification with the Asia (excluding Japan) sector. This fund compliments the other Asian fund we use (FSSA Asia Focus Fund, which we provided an overview of in April 2021).

The fund objectives are to outperform the MSCI AC Asia ex Japan benchmark (after fees) over a 3-5 year period. To do this the fund focusses on companies with visible earnings growth and sustainable returns.

The fund was established in 2011 and has £1,875 million invested across 60 funds (as at 30/11/2021).

Within the top 10 holdings you will see exposure to the following-

Taiwan Semiconductor Manufacturing Company – representing 9.7% of the fund – is the world’s most valuable semiconductor company. It has recently agreed construction of a factory in Phoenix, Arizona, in response to Trump’s warning about licences for electronics made outside of the US. This is an investment of $12 Billion.

Sea Ltd ADR – representing 2.4% of the fund – is a global consumer Internet company. The Company operates approximately three businesses across digital entertainment, e-commerce, as well as digital payments and financial services, known as Garena, Shopee and SeaMoney, respectively. Garena is a global online games developer and publisher, Shopee is the pan-regional e-commerce platform in Southeast Asia and Taiwan and SeaMoney’s offerings include mobile wallet services, payment processing, credit, and related digital financial services and products.

AIA Group – representing 2.2% of the fund – AIA is an American-founded Hong Kong multinational insurance and finance corporation. It is the largest public listed life insurance and securities group in Asia-Pacific. It offers insurance and financial services, as well as accident and health insurance, retirement planning and wealth management services.

In August 2013, AIA became the official shirt partner of the English Premier League football club Tottenham Hotspur. AIA’s contract with Tottenham was renewed in July 2019 to extend to the end of the 2026/27 season.

Geographically this fund’s top 3 regions by percentage of the fund is – Taiwan 9.54%, Republic of Korea 5.2% and China 4.72%

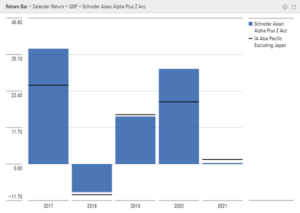

The Harmonic Portfolios are not constrained and funds are chosen on their asset allocation, being ‘Rated’ by Raynor Spencer Mills and of course, providing consistent investment returns. The following chart shows how the fund has performed over the last 5 calendar years, with the black line showing what the ‘average’ for the sector has achieved.

(click chart to enlarge and open in a new window)

Fund Focus: Pictet Global Environmental Opportunities

This fund is used within our Melodic 3-8 portfolios and represents between 3-11% of the spread within these portfolios.

We use this fund within our Socially Responsible Investment (SRI) portfolios to offer a degree of diversification within the Global Equities Sector. Pictet are a private bank and asset management company based in Geneva and founded in 1805.

The fund itself was launched in July 2011 and currently holds 11,650.61 million Euros (as at 3/1/2022) invested across 50 holdings.

Within the top 10 holdings you will see exposure to the following-

Synopsys Inc – representing 3.8% of the fund – is an American electronic design automation company that focuses on silicon design and verification, silicon intellectual property and software security and quality. Synopsys technology is at the heart of innovations that are changing the way we work and play. For example, autonomous vehicles, artificial intelligence, the cloud and 5G. These breakthroughs are ushering in the era of Smart Everything―where devices are getting smarter, everything’s connected and everything must be secure. Synopsys have been in business for over 35 years, employ over 16,000 employees and have an annual revenue in excess of $4 billion.

Agilent Technologies Inc – representing 3.6% of the portfolio – is a spin-off of Hewlett-Packard Company and broke records on Nov 18 1999 as the largest initial public offering (IPO) in Silicon Valley history. Agilent has a long history of innovation and leadership in the communications, electronics, semiconductor, test and measurement, life sciences and chemical analysis industries. Agilent employ approximately 16,300 employees, net revenue of $5.3 billion (year ending 2021) and have customers in 110 countries.

Autodesk Inc – representing 3.4% of the fund – is an American multinational software corporation that makes software products and services for the architecture, engineering, construction, manufacturing, media, education and entertainment industries.

Autodesk software has been used in many fields, on projects from the One World Trade Centre to Tesla electric cars.

Geographically this fund is weighted towards the US at 60% (which will come as no surprise based on the exposure to IT companies), Eurozone at 18% and Canada at 4.8%.

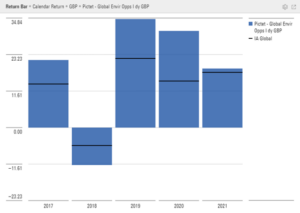

The following chart shows how the fund has performed over the last 5 calendar years, with the black line showing what the ‘average’ for the sector has achieved.

(click chart to enlarge and open in a new window)

The information provided in this report is based on our own opinion and offers no guarantee that our expectations will be met. Past performance is no guide to future results. As always, should you have any concerns you wish to raise, please do contact us.

Keep safe

Ian Pennicott AFPS

Chartered Financial Planner