With so many clients now having exposure to Socially Responsible Investments via our Melodic Portfolios, often in addition to holding the unconstrained Harmonic Portfolios, we will now issue reports on funds within both portfolios.

If you do not hold any Socially Responsible Investments and wish to do so, please contact us as it is easy enough to move part of your investment to this type of portfolio – no costs incurred either.

Premier Miton US Opportunities

This fund is used within our Harmonic 3-8 portfolios and represents between 5-7% of the asset spread with in these portfolios.

The reason we use this fund wit in our portfolios is due to the slightly different investment approach this fund uses. The majority of North American investment funds focus on what are known as FAANG stocks. FAANG is an acronym of the 5 prominent American technology companies- Facebook, Amazon, Apple, Netflix & Google.

This fund, established in 2013 provides another layer of diversification to the North American sector by focusing on non-FAANG stock and instead investing in the Financial Services, Industrial and Healthcare sectors.

With in the top ten holdings you will see exposure to the following-

Western Alliance Bancorporation – representing 3.5% of the fund – hold over $50 billion of client assets and are currently ranked #1 best performing bank in the us out of 50 public banks. They most recently acquired Amerihome mortgages which is a leading business to business mortgage platform in the US.

PluteGroup – representing 2.6% of the fund – are the 3rd biggest home builder in the US, having delivered on 750,000 homes across 40 cities.

Lowes Group – representing 2.6% of the fund – opened its first hardware store in 1921 in North Carolina. They now have over 2,200 stores across the US and Canada. Serving 20 million customers per week with $90 billion in sales through out 2020.

As of August 2021 the fund holds £1,267 million spread across approximately 40 companies with the top 10 holdings representing 27.5% of the funds.

In our view this is a well-diversified portfolio without too much bias to one sector or company, performs well and is a ‘Rated’ fund (by Rayner Spencer Mills) and compliments other North American investment funds within our portfolios

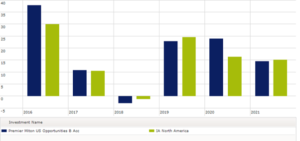

Overall this fund is well performing and it has done better than its Sector Average in four of the last five year. The Harmonic Portfolios are not constrained and funds are chosen on their asset allocation, being ‘Rated’ by Raynor Spencer Mills and of course, providing consistent investment returns.

Jupiter Ecology Fund

This fund is used within our Melodic 3-8 portfolios and represents between 8-10% of the asset spread with in these portfolios.

Socially responsible investments have become more popular over the last few years appealing to investors who have a preference towards avoiding investing in companies that produce or sell addictive substances (such as alcohol, gambling and tobacco), Armaments and nuclear power, in favour of companies that are engaged in social justice, environmental sustainability and alternative/clean energy and technology.

This fund has a particular focus on environmental infrastructure and resource efficiency. That is to say, they focus on companies which maintain and develop environmental infrastructure and who derive revenue from technology, products & services related to a more safe and secure usage of natural environmental resources and energy. The fund managers believe that, as the world population continues to grow, there will be ever increasing pressure on natural resources such as water, land and energy, and that this should create significant and long-lasting investment opportunities.

The fund, which launched in 2009, was the first authorised green unit trust to be launched in the UK. The fund holds in the region of £766m across 54 holdings (as of September 2021).

Within the top 10 holdings, representing 27.4% of the fund, you will find exposure to the following companies;

Koninklijke DSM N.V. – representing 3.3% of the fund – is a Dutch-based multinational life sciences and materials sciences company. The Company’s global markets include food and dietary supplements, personal care, feed, pharmaceuticals, medical devices, automotive, paints, electrical and electronics, life protection, alternative energy, and bio-based materials.

Waste Connections – representing 2.5% of the fund – is a North American integrated waste services company that provides waste collection, transfer, disposal and recycling services, primarily of solid waste. It has operations in both the United States and Canada. It is the third largest waste management company in North America.

Xylem Inc – representing 2.6% of the fund – is a large American water technology provider, in public utility, residential, commercial, agricultural and industrial settings. The company does business in more than 150 countries. Its products and services are focused in two areas: water infrastructure, which consists of businesses serving clean water delivery, wastewater transport and treatment, de-watering and analytical instrumentation; and applied water, which is residential and commercial building services companies, as well as industrial and agricultural application

Overall, we feel that the focus of this fund qualifies means it is an important contributor to the portfolio – hence the exposure we hold – and compliments the other funds we use in the global socially responsible sector. It has very good fund performance and is ‘Rated’ by Raynor Spencer Mills.

The information provided in this report is based on our own opinion and offers no guarantee that our expectations will be met. Past performance is no guide to future results. As always, should you have any concerns you wish to raise, please do contact us.

Keep safe

Ian Pennicott AFPS

Chartered Financial Planner