Model Portfolios have all shown a bit of recovery since the start of Russia’s invasion. However, whilst we recognise the economic effect will be felt more by Europe, it is anticipated that Global Growth will generally be reduced this year. The unknown factor is how long the conflict will last and therefore the economic impact of finding alternative supplies of fuel.

Market volatility has increased because of the uncertainty over Putin’s actions and until such times as we are a little clearer on the potential outcome, I am reluctant to make any changes to the portfolios. However, this is under regular review.

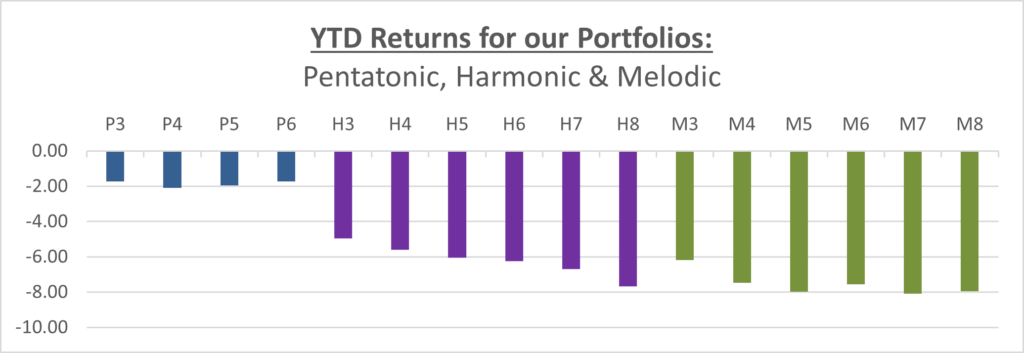

I have reduced the portfolio return by the maximum ongoing fee a client could pay (except Offshore Bond investors). The figures for the Pentatonic Income Portfolio assume income is reinvested as I am unable to strip out the dividend that has been paid.

The Melodic Portfolios have more exposure to US which is why they have suffered more this year – they increased more than the Harmonic Portfolios last year for exactly the same reason. The US is expecting reduced growth together with high inflation. Interest rate increases for the year have now been factored in and this economy should be the most resilient due to its own production of energy supplies.

The Pentatonic Portfolios have held their ground better primarily because of the lower exposure to the US.

The information provided in this report is based on our own opinion and offers no guarantee that our expectations will be met. Past performance is no guide to future results. As always, should you have any concerns you wish to raise, please do contact us.