Trying to sift through the information affecting global stock markets at the moment is particularly difficult because having survived the financial effect of Covid and global growth looking good, we have been hit with a number of issues;

The biggest is of course Russia and the potential increase in costs of Oil and Gas, particularly for mainland Europe because they are so reliant on the Russian supply.

This will have an effect on inflation worldwide, which had been low for the past couple of years because people couldn’t get out and about to spend their money. We are seeing very high levels of inflation and will continue to do so for the rest of year, when we should see it fall back in line with most Governments’ targets of 2%.

In order to reduce spending, and therefore inflation, Governments have increased interest rates which have been at historically low levels for a few years and it was inevitable they would increase at some stage. The expectation was that as Government spending on Quantitative Easing reduced, then interest rates would be increased and that this could be done over a period of years – it would have started in 2020 had we not had the Pandemic.

The Pandemic has contributed to inflation because the supply of goods has been affected though workforces being limited or even – China, for example – being stopped from working due to isolation.

We all know that a shortage of supply pushes prices up because people are prepared to pay more for something they can obtain quickly – or may need urgently.

We have now heard the parts of China are in continued lockdown in major manufacturing and technology hubs as part of its zero tolerance on Covid. There have been hints that Beijing may step away from its blanket policy as it is so reliant upon exports that interrupting its manufacturing base is having an effect of its economy.

The US has also seen inflation increase but are not directly affected by Russia’s invasion as far as Oil and Gas is concerned. Their bigger issue is the fact that Technology stocks – such a dominant sector in their stock market – have dropped as people are cutting back on their subscriptions due to cost of living increases from inflation.

I appreciate that seeing the Markets drop, and the value of your investments too, is disappointing but please remember that investments are always made for the medium to long-term and that market volatility is an inevitable part of the process.

Until the dust settles on Russia and the effect it will have on inflation, it is difficult to offer any sensible opinion on future outlook, so I do not propose giving any.

I can say that in all the time I have been advising clients, at times like this the best action is to take no action and just accept it as part of the investment process – and that inevitably, investments do recover. We just don’t know how long that will take.

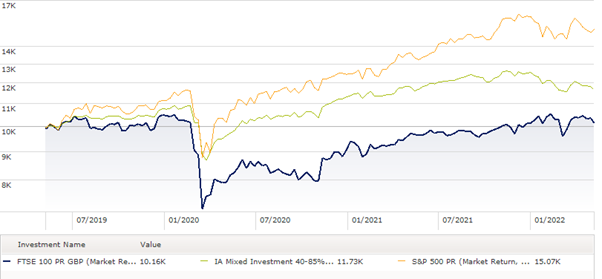

The following chart shows how the FTSE 100 and the S&P 500 have moved over just the last 3 years. The green line shows what the average Mixed Investment fund has done.

Markets suffered a big drop in 2020 when Covid hit us but you will see that whilst the US recovered very quickly, the UK took almost a year.

Because your investments hold funds exposed to both areas, as well as Europe and Far East – to a varying degree depending on the level of risk you have taken – your portfolio will have moved more in line with the green line and by the end of the year, we were seeing positive returns.

The falls we have seen so far this year are not as great as the Covid Crash and prior to the Russian invasion, global growth was being predicted at over 4% for 2022 and this has been revised down by 1%.

Nevertheless, we are still expecting growth and the general feeling is that stock markets have overreacted – time will tell.

The information provided in this report is based on our own opinion and offers no guarantee that expectations will be met. Past performance is no guide to future results. As always, should you have any concerns you wish to raise, please do contact us.

Ian & Oliver