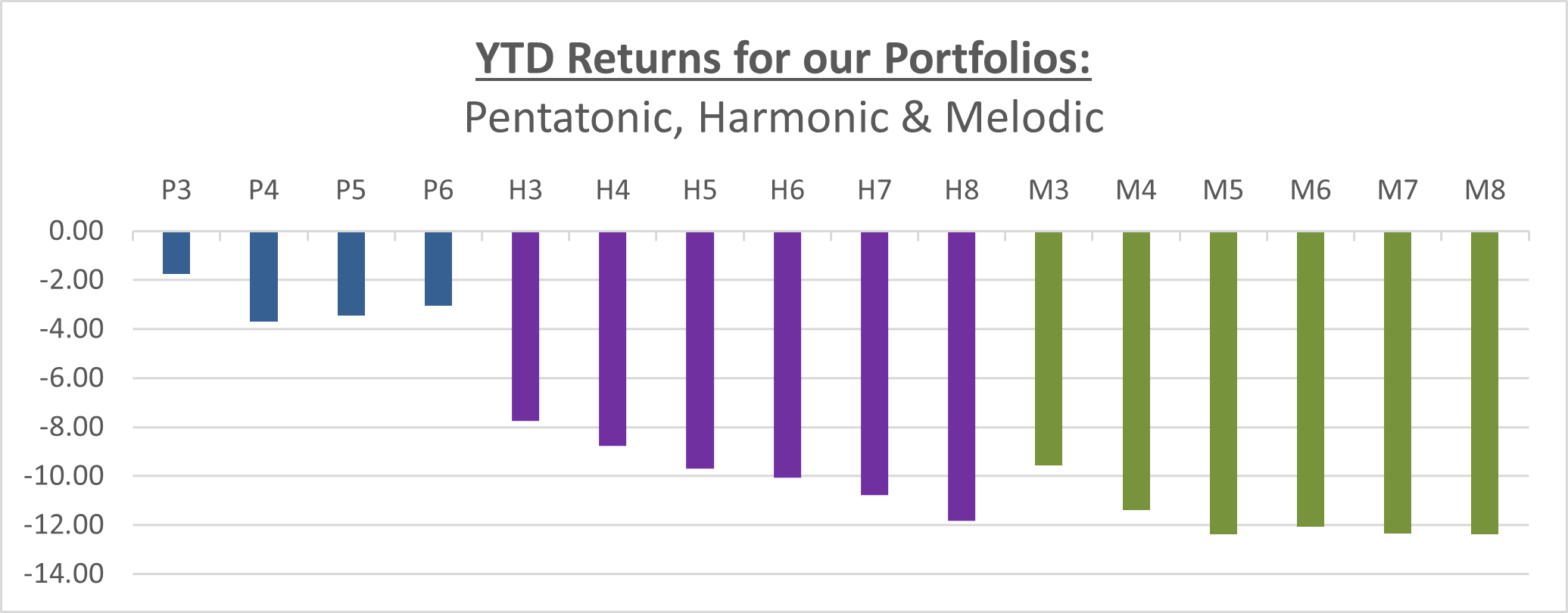

Model Portfolios have all dropped a little in May, due to the concerns over inflation and the increase in gas and oil as a result of Russia’s invasion.

We personally think that most of the ‘bad news’ is already priced in the Market and that it is overly pessimistic.

We will continue to see large movements as day traders try to take advantage of any news. However, because we are taking a longer-term view, we know that Markets recover – just not how long this will take – and we still expect Global Growth this year.

Inflation had been very low – less than the 2% target – during the Pandemic and some of the current high levels of inflation is making up for this. It is of course being affected by price increases – particularly fuel costs – but some of this is down to shortage of supply rather than the usual cause of inflation which is consumer spending.

We have seen American Technology stocks fall this year but having seen them increase so much during the Pandemic, it is not surprising they have dropped when people are able to go out to socialise rather than rely on digital services for their entertainment. The fall in these stocks has had a knock-on effect to other American shares but there is more potential of recovery from these other stocks. The US has had high inflation but it would appear that this has peaked.

I have reduced the portfolio return by the maximum ongoing fee a client could pay (except Offshore Bond investors). The figures for the Pentatonic Income Portfolio assume income is reinvested as I am unable to strip out the dividend that has been paid.

The Melodic Portfolios have more exposure to US which is why they have suffered more this year – they increased more than the Harmonic Portfolios last year for exactly the same reason.

The Pentatonic Portfolios have held their ground better, primarily because of the lower exposure to the US and because they target income producing investments which are normally more defensive during a period of volatility.

The information provided in this report is based on our own opinion and offers no guarantee that our expectations will be met. Past performance is no guide to future results. As always, should you have any concerns you wish to raise, please do contact us.

Best wishes

Ian and Oliver Pennicott

Independent Financial Advisors