With so many clients now having exposure to Socially Responsible Investments via our Melodic Portfolios, often in addition to holding the unconstrained Harmonic Portfolios, we will now issue reports on funds within both portfolios.

Socially Responsible Investments (SRI) have become more popular over the last few years appealing to investors who have a preference towards avoiding investing in companies that produce or sell addictive substances (such as alcohol, gambling and tobacco), Armaments and nuclear power, in favour of companies that are engaged in social justice, environmental sustainability and alternative/clean energy and technology.

If you do not hold any Socially Responsible Investments and wish to do so, please contact us as it is easy enough to move part of your investment to this type of portfolio – no costs incurred either.

MI Chelverton UK Equity Growth Fund

This fund is used with in our Harmonic 3-8 portfolios and represents between 6-7% of the asset spread within these portfolios.

The reason we use this fund is due to the different investment approach this fund uses. It specifically focuses on Small to Mid-Cap companies which are listed on the UK stock exchange but outside of the traditional top 100 companies many UK equity funds focus on.

We think this provides a level of diversification within the UK Equity Sector and nicely compliments the other UK equity funds we use to form your portfolio.

This fund was established in 2014 and currently holds £1,770 million invested across 175 holdings (as of 30/09/2021).

Within the top ten holdings you will see exposure to the following-

Future PLC – the largest holding, representing 2.5% of the fund, is a British media company. Established in 1985 it currently connects nearly 400 million people around the world each month with their interests, hobbies and passions through websites, events and magazines. Today they produce over 175 magazines such as Fourfourtwo, Golf monthly, Horse & Hound, Marie Claire & Rugby World. This year they bought the GoCo Group which owns Go Compare, Look After My Bills and My Voucher Codes

Big Technologies PLC– representing 1.8% of the fund, was founded in 2005 with an innovative idea to create a GPS device small enough for a child to carry, which you may know as Buddi. Following the initial launch, the device quickly took off when local authorities responsible for delivering adult social care started using it. Nowadays their device is used by over 100 organisations including the NHS.

Premier Foods– representing 1.3% of the fund, is a British food manufacturing company which was established in the early 18th century. Nowadays it is responsible for manufacturing, processing and distributing food worldwide. Brands such as Mr Kipling, Ambrosia, Birds Custard and Angel Delight are just a few that they manufacture.

In our view this is a well-diversified portfolio without too much bias to one sector or company. It performs well and is a ‘Rated’ fund (by Rayner Spencer Mills).

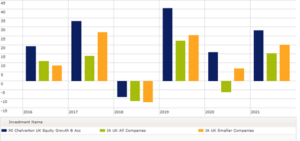

This fund has done better than its Sector Average in each of the last five years. I have shown the UK All Companies Sector average as well as the UK Smaller Companies average to show why a spread is important.

The Harmonic Portfolios are not constrained and funds are chosen on their asset allocation, being ‘Rated’ by Raynor Spencer Mills and of course, providing consistent investment returns.

BMO Responsible Global Equity Fund

This fund is used within our Melodic 3-8 portfolios and represents between 5-15% of the asset spread within these portfolios.

We use this fund within our SRI portfolios to offer a degree of diversification within the Global Equities Sector. BMO (Bank of Montreal) have one of the most detailed and stringent processes of any investment firm and will only choose to invest in a company once their responsible investment team have undertaken thorough due diligence that the company meets their SRI criteria.

This fund, established in 2003 currently holds £1,373 million invested across 51 holdings (as of 30/09/2021).

Within the top ten holdings – representing 33% of the fund – you will see exposure to the following-

Linde plc – representing 3.7% of the fund, is a global multinational chemical company founded in Germany and since 2018, domiciled in Ireland and headquartered in the United Kingdom. Linde is the world’s largest industrial gas company by market share and revenue. It serves customers in the healthcare, petroleum refining, manufacturing, food, beverage carbonation, fibre-optics, steel making, aerospace, chemicals, electronics and water treatment industries

Illumina Inc. – representing 2.8% of the portfolio, is an American company which develops, manufactures and markets integrated systems for the analysis of genetic variation and biological function. The company provides a line of products and services that serves the sequencing, genotyping and gene expression, and proteomics markets. Its headquarters are located in San Diego, California.

Illumina’s technology had purportedly, by 2014, reduced the cost of sequencing a human genome from $1 million to $1,000. Customers include genomic research centres, pharmaceutical companies, academic institutions, clinical research organisations & biotechnology companies.

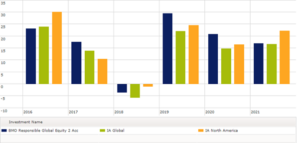

The largest exposure within the fund is Apple Inc at 6% with Linde being the second largest. The fund also holds Mastercard and Taiwan Semiconductor Manufacturing Co Ltd in the top 10. The fund does have a bias to North America at 63% so we use this fund as part of our exposure to the USA. I have therefore provided a table showing how the Global and North America Sector averages have performed over the past 5 years and you will see this fund has done vary well compared to both averages.

The information provided in this report is based on our own opinion and offers no guarantee that our expectations will be met. Past performance is no guide to future results. As always, should you have any concerns you wish to raise, please do contact us.

Keep safe

Ian Pennicott AFPS

Chartered Financial Planner