Following yesterday’s Autumn Statement from the Chancellor, we have clearly set out the main changes which are likely to impact you, with many key personal allowances being frozen and or reduced.

As a client of ours we will ensure that you are using all the tax efficient investments available.

Income Tax

The personal allowance and higher rate threshold will be frozen until 2028. This is £12,570 with the higher rate threshold being £37,700 above this.

The additional rate threshold will be reduced from April 2023 to £125,140 (previously £150,000).

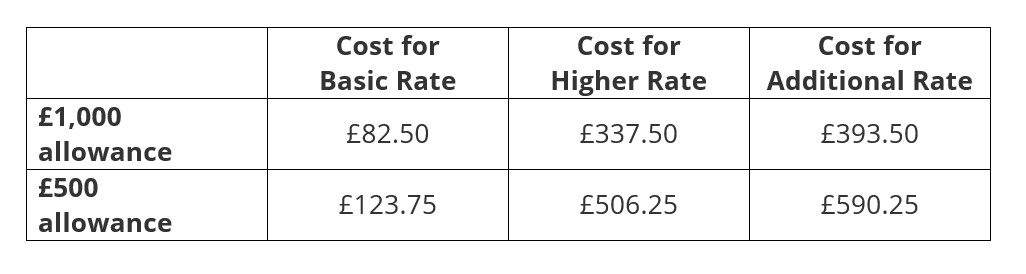

The dividend allowance is currently £2,000 which will fall to £1,000 from April 2023 and fall further to £500 from April 2024.

This will cost savers the following when compared with the current £2,000 allowance:

Capital Gains Tax

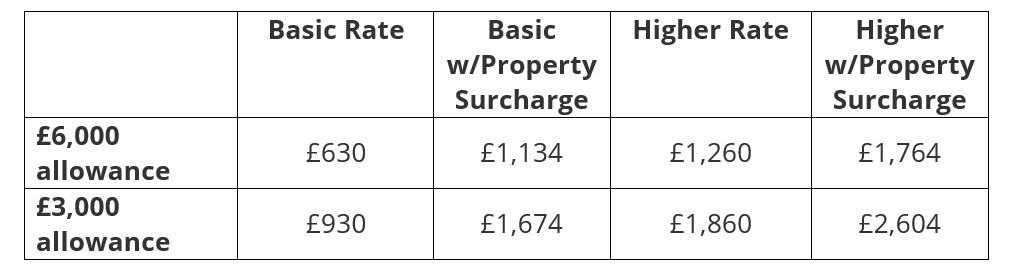

The personal Capital Gains Annual Exempt Amount will reduce from £12,300 to £6,000 from April 2023, and £3,000 from April 2024.

This will cost savers the following compared with the current £12,300 allowance:

Inheritance Tax

The main bands are to remain frozen until April 2029. The Nil-Rate Band is £325,000 and the Residence Nil-Rate band is £175,000.

ISA Allowances

These are to remain at current levels of £20,000 for ISA and £9,000 for a Junior ISA.

Pensions

The Chancellor confirmed that the basic state pension and new state pension will increase by inflation (10.1%) next April.

There was no mention of the annual allowance in the Autumn statement which is currently £40,000.

The State Pension age timetable is currently under review until next year. This timetable can be found here.

Contact us on 01803 873978 or complete the form below for friendly, independent and impartial advice. We offer a free, no obligation, 30-minute consultation to discuss your personal circumstance and establish how our services could help you.