August’s newsletter would normally provide a summary of what’s happened in the last quarter and the outlook for the rest of the year. As we are in such unusual times due to the invasion or Ukraine, cost of fuel, concerns over recession and impending interest rate increases it is pointless offering any thoughts on the future as no-one has a crystal ball. I thought it more relevant to remind you why investing always has its ups and downs.

The ‘usual’ safe investments are unfortunately not as safe as people imagine. Think about cash you hold and the fact that inflation has been over 9% in the last 12 months. It means the buying power of your cash has dropped by 9% – for a ‘risk free’ investment!

Many investors are getting used to a variety of political, financial and economic factors and learning to look through the ‘noise’ to focus on what really matters.

Portfolio diversity holds the key to approaching your investments and managing risk.

It is important to think about longer-term timescales instead of focusing too intently on short-term events and market fluctuations.

Adopting the longer-term view

Investment requires a disciplined approach and a degree of holding your nerve if markets fall. Experienced long-term investors know that the worst investment strategy you can adopt is to jump in and out of the stock market, panic when prices fall and sell investments at the bottom of the market.

Finding the right balance

However concerning market fluctuations may be, it’s important to remember that we have jointly worked hard to formulate a financial plan which is in line with your personal requirements.

Diversifying your portfolio

Successfully achieving your long-term investment goals requires balancing risk and reward. By selecting a broad range of assets in line with your attitude to risk, objectives and time horizon, diversification aims to provide the potential to improve returns for your elected level of risk.

Communication is key

As an investor, you have to decide how much risk is right for you. While the process of building a portfolio will incorporate strategies designed to help reduce risk, it cannot be eliminated altogether.

We also need to make sure that we are aware of any changes in your objectives or circumstances. And, of course, you should remember that volatility also creates opportunities for investors.

5-year view

When we talk about investing, we always emphasis the need to invest for at least 5 years. This gives a lot of potential of achieving a positive return over this timescale whilst being aware that values may well drop during this period.

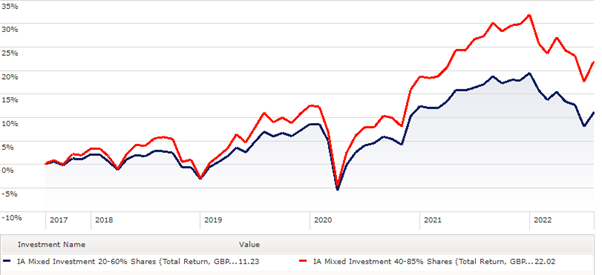

The following chart shows what has happened in the past 5 years when we have had Brexit and a trade war between the US and China in 2018, Covid in 2020 and 2022 the problems you will be familiar with.

However, if you invested in an ‘average’ fund in August 2017 you would still be showing a profit. The red line is level 5 risk and above, and the blue line a level 3 and 4 risk

I am pleased to say that the Portfolios we have designed, have performed better than the average over this period even allowing for our fees.

The value of investments can go down as well as up and you may not get back the full amount you invested.

The past is not a guide to future performance and past performance may not necessarily be repeated.